Vertical SaaS

As the era of cost inflation leads to a slowdown in demand, manufacturers are under enormous pressure to control margins. Vertical platforms will evolve into fully-fledged operating systems for businesses and replace hacked-together tech stacks to bring every aspect of business operations together in a single solution. Often attractive to businesses not yet using software, these platforms tend to start with one core function. Over time, they expand until they are the operating system for the entire business, offering customer relationship management, payments, insurance, and more. Ultimately, they become lifelines, as indispensable to companies as electricity.

Our investment in Givebutter, a donor management software for nonprofits, is a good example of this trend.

Focus areas.

Vertical SaaS

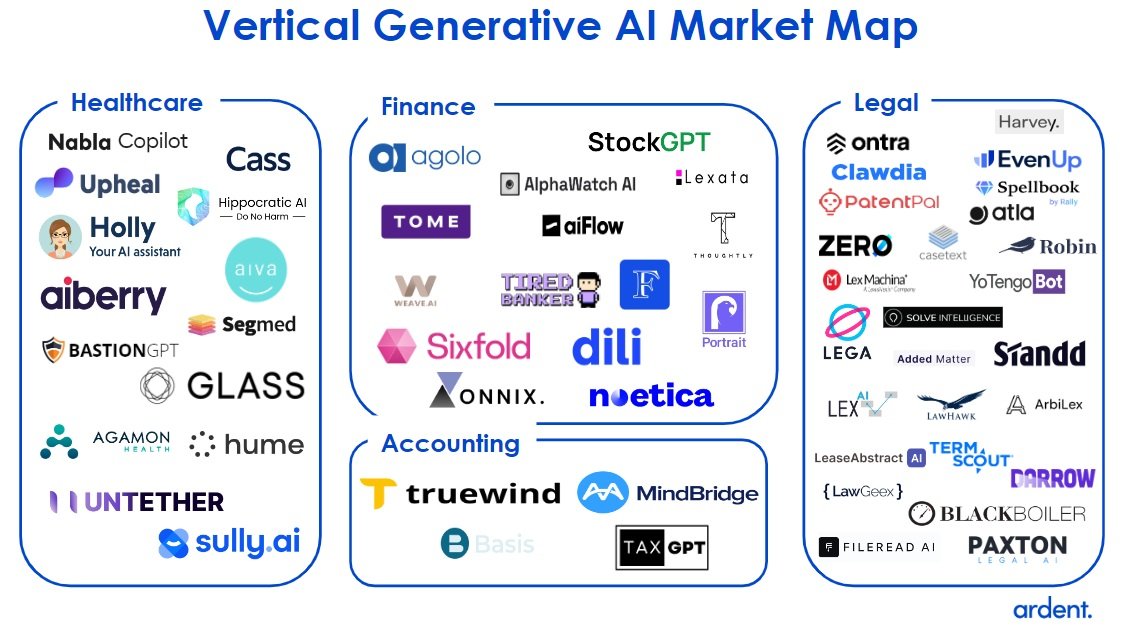

We are interested in two types of vertical saas: those catering to SMBs and those leveraging LLMs to automate unstructured data.

Small- and medium-sized businesses (SMBs) are the ideal target for SaaS that can "do everything" because they are less likely to pay for expensive software. Low price points and different business models facilitated by embedded finance enable “freemium” models that serve the even smallest, least-tech-savvy businesses. For sophisticated enterprises, innovation within artificial intelligence and software built atop data warehouses solves pain points that current software providers miss. With customers reaching their limit on new technology, vertical SaaS consolidates solutions and simplifies their tech stack.

To learn more about our thesis focus on AI-native vertical saas, click here.

Vertical B2B Marketplaces

Verticalized B2B marketplaces connect buyers and sellers in a particular industry and do much more than match supply and demand. We are interested in the opportunity to embed financial products and services that facilitate transactions within these marketplaces. By offering core workflow products that use traditional SaaS tools and features, as well as marketplace functions, they can fully entrench themselves into businesses. Sellers will have even greater incentives to participate in the market to access buyers and vice versa.

Interconnected supply chains

As supply chains grow ever longer and more global, the complexity of sourcing, building, and delivering products has increased exponentially. The pandemic highlighted the risks of relying on a single party and the need for resiliency and redundancy. Despite this, the sector remains predominantly offline, driven by pen, paper, and personal relationships. Rising geopolitical tension is causing key stakeholders to move relationships and suppliers near-shore or “friend-shore”. Visibility, cross-border payments, insurance, competitive pricing, and sourcing are difficult in this environment. From procuring raw materials to the last mile of delivery, the value chain has countless opportunities ripe for digitization.